The Federal budget handed down by the new Labor government has some surprising and noteworthy features. The budget surplus of $4.2 billion is impressive and shows some fiscal restraint, which will help the RBA’s inflation fight. However, longer-term forecasts for the budget and government debt remain worrying.

Key takeouts from the Federal budget include:

Winners:

- Single parents

- Low-income households

- Small businesses

- Aged care workers

- First home buyers

- Renters

- Skilled migrants

- Tertiary students

- Defence personnel

- Public service

Losers:

- Superannuation and tax dodgers

- Smokers and vapers

- Consultants to the government

- Superannuants

- Scammers

- Travellers

- Truckies

- Big gas polluters

Other important points to consider from the budget are:

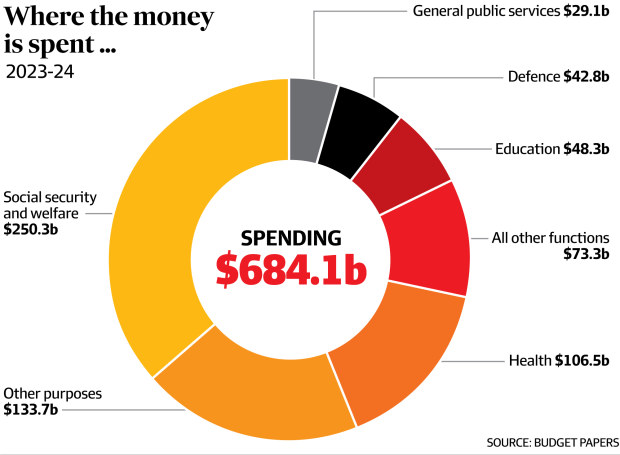

- $9.5 billion increase in welfare

- $1.5 billion one-off energy bill discounts

- $3.5 billion to lower cost of going to the doctor

- Inflation forecast to fall from 6% this year to 3.25% in the next financial year and 2.75% the financial year after that

- Unemployment forecast to rise from 3.5% to 4.5%

- Economic growth forecast to slow from 3.25% this year to 1.5% next year

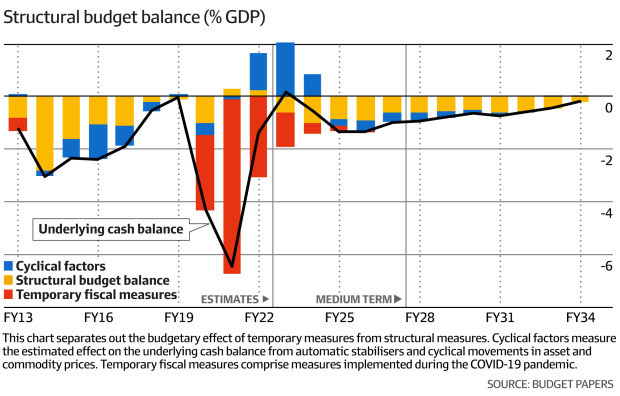

- Forecast deficit of $13.9 billion next year, growing to $36.6 billion in 2025-26, with deficits out to at least 2033-34.

- Gross debt to reach $1.02 trillion by 2025-26, net debt to reach $703 billion by 2026-27

Overall, the budget measures announced are unlikely to significantly impact markets. The surplus and other benefits outlined in the budget are welcome news for many, but the longer-term implications of government debt and deficit remain a concern. The government will have to make tough decisions in curbing significant expenditure ahead, spending big to secure their voter base, or doing nothing and relying on the economy to right itself.