Market and Economic Update

The June quarter was one for the record books – the lowest Australian unemployment rate since 1974 and the highest US inflation rate since 1981 – all while markets shifted from pricing inflation risks to pricing recession risks, against a complicated backdrop including the threat of an escalating war on Europe’s doorstep, increased supply challenges caused by both the Russia / Ukraine conflict and COVID lockdowns in China, and concerns regarding energy and food shortages globally as the price of both skyrocketed.

Recent hopes that we might have seen ‘peak’ inflation proved to be premature, as inflation continued to rise in many jurisdictions, with tight labour markets leading also to a surge in wages, with wage earners attempting to keep up with escalating energy, food, and shelter costs. This escalating inflation, and ongoing strength in ‘hard’ economic data like retail sales and employment emboldened central banks to move more aggressively on the rates front, with larger than normal rate rises of 0.5% or even 1.0% becoming commonplace.

Towards the end of the quarter, this combination of rapidly rising interest rates, increasingly negative economic commentary, and higher costs of living started to have an impact on some of the ‘softer’, leading economic indicators such as consumer and business confidence, as well as causing notable declines in the housing and construction markets. While this is exactly the point of interest rate rises – to dampen economic activity, and therefore reduce inflationary pressures, the market did start to worry in the period about the possibility of central banks overplaying their hand, and tipping economies into recession.

This busy and complicated backdrop played out in global markets through further falls in bonds, as investors priced in both stubbornly high inflation, and the more aggressive action being taken by central banks to curtail it. Unsurprisingly, with both higher interest rates and emerging fears of inflation, growth asset classes such as Property and Equities all fell reasonably sharply in the

period, with growth and technology companies, and businesses operating in economically sensitive sectors such as consumer discretionary particularly hard hit. Infrastructure was the star performer in the period, with investors attracted to its defensive cashflows and inflation protection, while Asian and Emerging Market equities were the surprise packet – holding up relatively well as China softened its regulatory crackdown, and began to provide stimulus to their economy to lift it out of the doldrums after extended COVID lockdowns.

Looking ahead, and with interest rates still well below ‘neutral’ levels, the combination of already weakening economic data and stubbornly high inflation presents a conundrum for central banks. Tighten too far, and they risk causing a recession, while a ‘soft touch’ on rates risks embedding inflationary expectations, ultimately leading to even higher rates than would otherwise be necessary; all suggesting that a short and sharp rate hiking cycle remains the most likely outcome. With most global economies (apart from Europe) entering this tightening phase from a position of relative economic strength, with full employment, strong corporate balance sheets, high household savings rates and strong equity and property prices, a ‘soft landing’ from here is still a possibility, but until more clarity emerges, markets are likely to remain on edge, with higher than usual volatility persisting.

Portfolio Summary

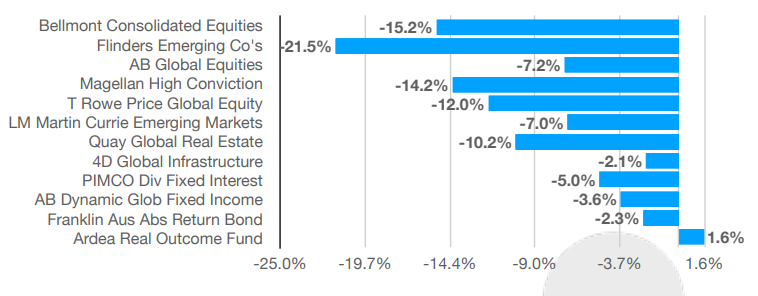

Quite simply, there was nowhere to hide in the June quarter, with negative returns across the portfolio, in line with weak markets in the period. Relatively speaking, our international holdings fared slightly better than local, not so much because of better headline performance at the fund level, but because of the fall in the Australian dollar in the period, which cushioned those falls once converted back to Australian dollars. This is a very attractive dynamic of maintaining an un-hedged currency exposure; because the Australian dollar tends to fall when global uncertainty rises, which is of course when markets fall most sharply, currency tends to provide a nice shock absorber for the returns of our international holdings. In the June quarter this translated to returns on our international holdings of between 5% and 7.5% better than they would have been, if we had a hedged currency position. While hedging is something that we may contemplate in the future if we believe the Australian dollar is at the extreme low end of its likely range, this positive structural dynamic means that the bar is fairly high for us to move away from our unhedged exposure.

From an asset allocation perspective, our overweight position in International equities vs Australian equities paid off for us in the period, although this was driven entirely by the currency effect described above, with global market falls in US dollars actually larger than what we saw locally, and continued weak performances from Magellan and T Rowe Price as a result of their heavy exposure to high quality, growing technology companies. While Magellan in particular has had disappointing performance in recent periods, and been in the press for all the wrong reasons, we remain very impressed by the capability of their investment team, and actually like the look of their portfolio at the moment, which is very high quality; by which we mean strong, growing profitability, solid balance sheets and pricing power – all characteristics that we think are essential in either an inflationary, or recessionary environment. AB Global Equities fared much better, outperforming the market as a result of their strong focus on cashflows and discipline around valuation. Interestingly, property falls were broadly in line with equity markets in the period, as investors fretted about both recession risks and rising interest rates. Infrastructure on the other hand fared relatively better – held up by defensive earnings streams, and strong inflation protection, although our holding in this space – 4D Global Infrastructure slightly underperformed its benchmark in the period, due to its more cyclically exposed portfolio. Bond returns remained weak on an absolute basis, as interest rates rose, and credit spreads started to widen. Relatively speaking our bond holdings performed quite well though, with our lower interest rate exposure and

very high credit quality enabling our holdings to do significantly better than the bond benchmarks, with Ardea the absolute standout in this respect, swimming hard against the tide to deliver a positive return in the period.

Portfolio Returns – June Quarter 2022

While we haven’t made any changes to the portfolio in the period, we are actively considering increasing duration, or interest rate risk in the portfolio moving forward, on the basis that market pricing of future interest rates is appearing somewhat aggressive, and this exposure would provide nice protection for us if the economy were to have a significant downturn. Otherwise we remain very comfortable with how the portfolio is positioned, confident that our underlying theme of ‘Quality’ will continue to hold the portfolio in good stead as recession risks mount.

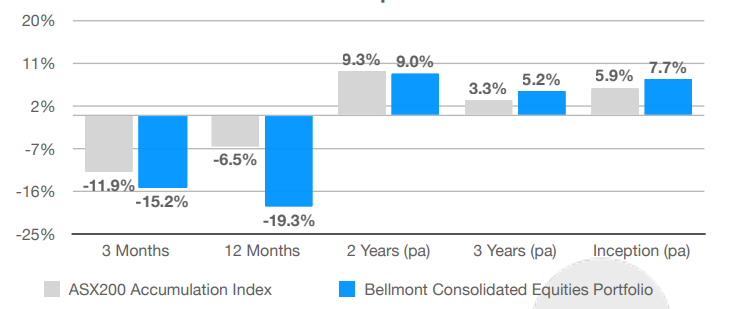

For those that are interested, a more detailed review of the Bellmont Consolidated Equities Portfolio is found below, with an in-depth video covering the quarter from an Australian Equities perspective is available here.

Direct Australian Share Portfolio

Given the significant falls seen on most global sharemarkets, the Australian market actually held up relatively well. Or perhaps more accurately, the very top end of the Australian market held up well. The benchmark ASX200 accumulation index, driven predominantly by its top 20 holdings, fell by only 6.5% for the full financial year, and is one of the few global markets to remain less than 20% below recent highs. Smaller companies on the other hand, fell more in line with the steep declines seen in global markets, down 19.5% for the financial year. Our own portfolio suffered a 19.3% fall for the financial year, almost all of it in the last 6 months, hit by both our exposure to some smaller companies, as well as disappointing performances from a couple of

our individual holdings – some of which we consider to be quite justifiable, and some not. While this disappointing result did pull our long term performance numbers back, pleasingly our returns since inception of 7.7% p.a. after all fees remains comfortably ahead of the market over the same period.

This dynamic that we’ve seen in the past 6 months, where smaller companies have fallen earlier, faster and further than larger companies is not new – in fact it’s something that happens in most selloffs, driven largely by institutional investors concentrating their portfolios in the biggest and most liquid companies, in order to ensure that that they’re able to meet any redemptions demanded by investors as markets fall. This increased focus on liquidity ahead of fundamentals also creates opportunity though, with smaller companies in many instances being sold indiscriminately to levels significantly below their true value, enabling the smaller end of the market to recover from downturns far faster than the broader market.

Of course, while all this discussion about markets and sectors is useful to a degree, too much of a focus on such high level factors can easily do more harm than good, if it renders us unable to see the forest for the trees. It’s important to remember that we don’t invest in markets, we invest in businesses. And the best barometer of the success of a business is its long term profitability, not its share price. While a company’s share price can often be a reasonable and rational estimation of the value of its business, based on both its existing profitability and prospects for growth, that certainly isn’t always the case – especially at times of heightened emotion in the markets. While the market might price businesses efficiently on average, when either fear or greed are particularly prevalent, price and value can diverge quite meaningfully. As Warren Buffet (and more recently Roger Montgomery) is so fond of saying “Price is what you pay; Value is what you get.” When our analysis suggests that prices exceed value, we are more than happy to either sit on our hands, or as we’ve been forced to do in recent years, look a little further afield in search of reasonable value. But when fear reigns, and prices are meaningfully below our assessment of value for high quality, well managed businesses, with solid long term prospects, we get excited. For the first time in some years (COVID excluded) this is the situation we now find ourselves in, and we’ve been busily at work taking advantage of select opportunities in the last few months, with two new, exceptionally high quality companies added to the portfolio in the last 3 months, at prices that we think significantly underestimate their true value.

Our first new purchase in the period was Baby Bunting (BBN) – Australia’s largest specialty retailer of maternity and baby goods. Baby Bunting (BBN) enjoys a dominant market position as the only specialty retailer of its kind in the country, providing the company with deep and sustainable moats around product range, buying power, brand recognition and marketing spend, and positioning them as a realistic ‘category killer’ in their space. Around 44% of the company’s sales are from private label, or exclusive products, adding to their already strong pricing power, and given the nature of products that they sell, the company enjoys relatively stable and consistent demand patterns. Over the last 10 years they’ve managed to grow same store sales by 6.7% p.a., and total sales by 16% p.a., enabling them to take their market share from 8% in FY15 to 21% today. Profits have grown strongly too, with EPS growth averaging more than 30% per annum over the last 3 years, and management remuneration hurdles for 10% to 20% medium term EPS growth indicating the board’s expectations for further strong growth moving forward. Positively, the company is only around half way into its planned store rollout, which in addition to the expanding margin profile from maturing stores, gives us strong confidence in significant future earnings growth as well. With the Baby Bunting (BBN) share price having fallen by around 40% in the last year, while earnings have likely grown by around 20%, we felt that sufficient value had emerged to take an initial 4% weighting in this very high quality company, at just above $4 per

share. With our strong confidence in the quality of the business, and its future prospects we would be delighted to add further to our holdings if a suitable opportunity were to arise.

Bellmont Consolidated Equities Portfolio – June 2022

And secondly, we re-purchased Domino’s Pizza Enterprises (DMP) shares, a business that we had previously held in the portfolio, and had always remained very impressed with, but sold on valuation grounds in late 2020 and early 2021. We have long viewed Domino’s (DMP) as having one of the strongest, and deepest management teams on the market, with the company’s relentless push for improvement in all areas of their business a major driver of the company’s extraordinary successes over the last 10 years. From humble beginnings in the early 1990’s, the company now holds the master franchise rights to the Domino’s brand and network in Australia, New Zealand, Belgium, France, The Netherlands, Japan, Germany, Luxembourg, Denmark and Taiwan, with a network of more than 3,300 stores. They have managed to grow both earnings per share and sales per share by more than 20% per annum over the last 10 years, and with significant opportunities for further store rollouts in Europe and Asia, look likely to continue their strong growth moving forward as well. With the company’s future earnings growth prospects better than ever, as their European and Japanese operations really start to hit top gear, and on the back of the company’s share price falling by around 60% from its recent highs, we were delighted to be able to re-invest in this exceptional business with an initial 3% weighting, and remain on the lookout for opportunities to add further.

Without enough cash to take advantage of all of these buying opportunities, we were forced to make some tough decisions in the period, and sell down a couple of our existing holdings. To be clear, we are delighted to have to make hard choices like this, that force us to measure our existing holdings up against what is becoming an increasingly challenging yardstick of other alternative uses of those funds. In portfolio management just as in sport, increased competition for places can only improve the quality of a team.

In this instance, we chose to exit our holding in Super Retail Group (SUL), while slightly reducing our holdings in NIB Holdings (NHF). With Super Retail Group (SUL), we would have been perfectly happy to continue holding on a standalone basis, but felt that Baby Bunting (BBN) was better placed to handle either a recessionary or inflationary environment, as a result of the less cyclical demand for their products, and their strong pricing power, which combined with their significant growth rate provided us with more confidence in the growth of their earnings moving forward. Even after this small sale, NIB Holdings (NHF) remains our second largest position – which should tell you a bit about our confidence in their future prospects. With what had grown to be quite a large weighting though, and Domino’s (DMP) banging down the door for inclusion, we felt it was reasonable to trim our NIB Holding (NHF) slightly, in order to fund our Domino’s (DMP) purchase.

Looking forward, we certainly can’t predict when these challenging market conditions will end. The sudden re-emergence of inflation, and resulting rapid increase in interest rates has created turmoil for investment markets, leading to wild swings in market prices for almost all assets. But with central banks still only part way through their anticipated tightening cycle, it’s far from clear that we are past the worst of the market turbulence. Importantly though, from our perspective these short term swings in market prices are not a concern; in fact to the extent that asset prices swing wildly WITHOUT a corresponding swing in the long term earnings prospects of the businesses themselves, they provide opportunities – such as those we’ve described above that we’ve already taken advantage of. Of slightly more concern is the prospect of these changes (inflation and interest rates) leading to a significant economic slowdown, the likelihood of which appears to be growing almost by the day right now. A broad economic slowdown would undoubtedly lead to reduced earnings in the short term for many businesses in our portfolio, especially those most exposed to consumer spending. But ironically, IF a significant economic slowdown occurs, we would actually expect it to benefit our portfolio in the long term – as our businesses are overwhelmingly among the best run, most profitable, and most conservatively financed businesses in their respective sectors. And as in all downturns, what we are likely to see is that the weakest companies in each sector end up going out of business, while the strong businesses that remain mop up this extra market share – either organically, or through acquisitions, and emerge from the downturn significantly stronger than they went in. We see this in every downturn, but most recently in COVID – with the greatest benefits unsurprisingly accruing to those businesses that were most directly impacted (eg Corporate Travel, Flight Centre, Accent Group, Money3 etc), and we would certainly expect to see the same occur this time, IF this scenario plays out. Given our acknowledged inability to predict the broad direction of markets, this sort of ‘anti-fragile’ portfolio, that stands to benefit in the long term from any short term disruption, is in our opinion, the only sensible long term investment approach.

So what does all this mean for us as investors? Sit tight. Focus on the long term trajectory of earnings, not the short term volatility of share prices. Invest in quality businesses, run by capable management, where you can be virtually certain their earnings per share will be materially higher in five and ten years time. Be fearful when others are greedy, and greedy when others are fearful. If we focus on the fundamentals, the returns will look after themselves.

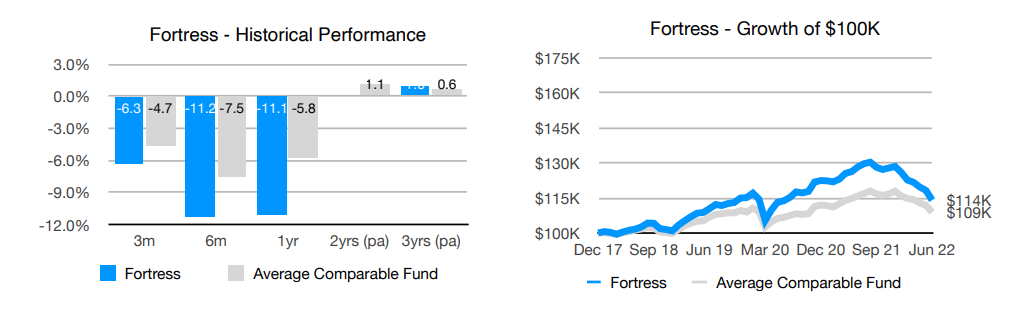

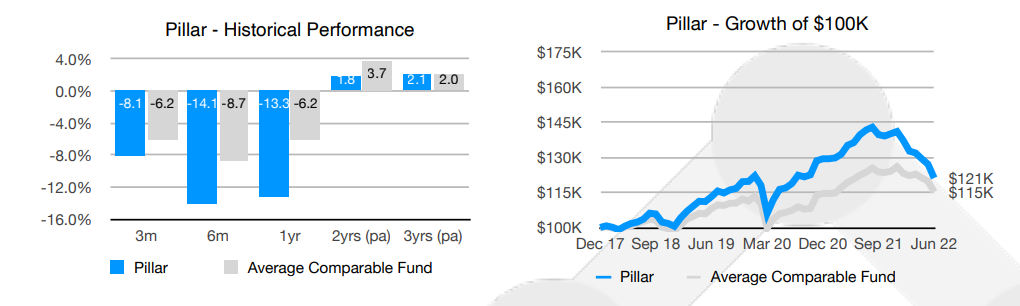

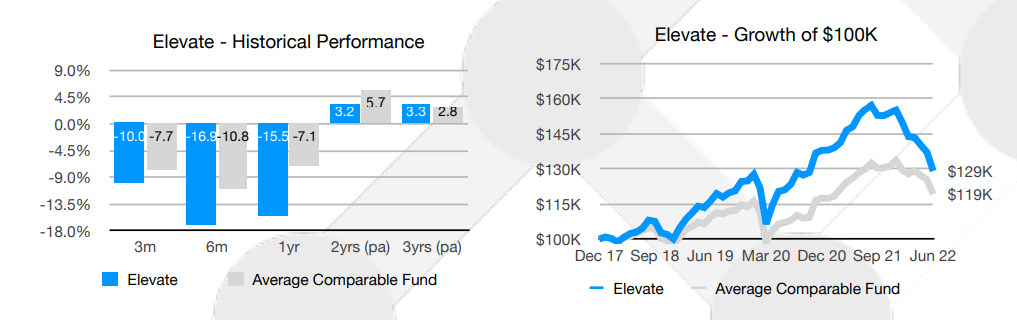

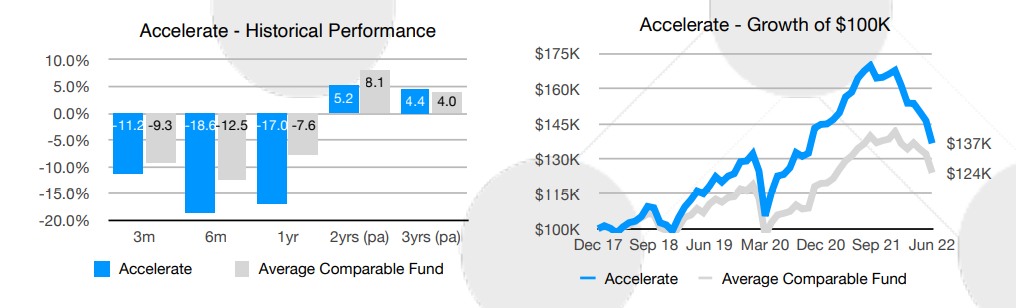

Model Portfolio Performance

Past performance is not indicative of future returns. Returns are current as at 30/06/2022 and are net of all underlying fund manager fees, but do not include Bellmont’s model fee, platform and transaction fees, taxes or the cash rebates some of the fund managers pay into client accounts. Inception date of models is 1/1/2018. Note that actual portfolio performance will differ from model performance, based on entry and exit date, rebalance frequency and other factors.