Market Overview

The March quarter was tough for growth assets, with equities, property and infrastructure prices falling, while defensive assets like cash and bonds held up reasonably well. Australian bonds performed well as bond yields fell, while Emerging Market equities performed strongly. Currency unhedged exposures held up better as the Australian dollar fell in the quarter. Growth assets with a yield focus, like Australian equities, Australian & Global listed property and infrastructure came under significant pressure on concerns global bond yields may rise significantly from here on the back of hawkish rhetoric from the US central bank. US equities fell as US tech stocks sold off on Facebook’s data breach and President Trump publicly attacked Amazon. European equities also came under pressure as trade war fears escalated with the US and Chinese leaders trading barbs.

Volatility continued to rise over the quarter with investors being pulled into a variety of escalating issues. Equity investors eagerly anticipated quarterly US corporate reporting season, with market expectations of earnings growth rising to circa 19%, largely on the back of the first full quarter of US tax cuts.

Economic News

On the economic front, not a whole lot changed from the previous quarter. The US Fed raised rates as expected at its quarterly meeting, but indicated it remained patient regarding future potential rate moves. European data changed course slightly, with some indicators starting to turn negative, no doubt a function of concerns regarding potential trade wars, but also a function of rising input costs as inflation begins to rise globally. The RBA remained on hold regarding rates, expecting better economic conditions ahead, but citing no pressure on inflation as yet. Plenty of activity on the political front, which also spilled over into April. The potential for a trade war escalated as the US and the Chinese went tit-for-tat imposing tariffs on each other. The US government was forced to shut-down again after breaching their self-imposed budgetary debt ceiling, with agreement reached only after President Trump and the Senate threatened each other. The US government also stepped up their attack on the Russians over voter interference in the presidential election. Voters in Italy delivered a hung parliament while the North Koreans moved closer to agreeing to talks with the US on denuclearisation. Back home, the Federal Coalition came under pressure as polls continued to point to a Labor win at the next election. The Labor party also dug their heels in on key issues including threatening to repeal any corporate tax cuts, make changes to the tax treatment of franking credits, and making a case for capital gains tax reform. Geopolitical risks escalated during the quarter and look likely to remain elevated moving forward.

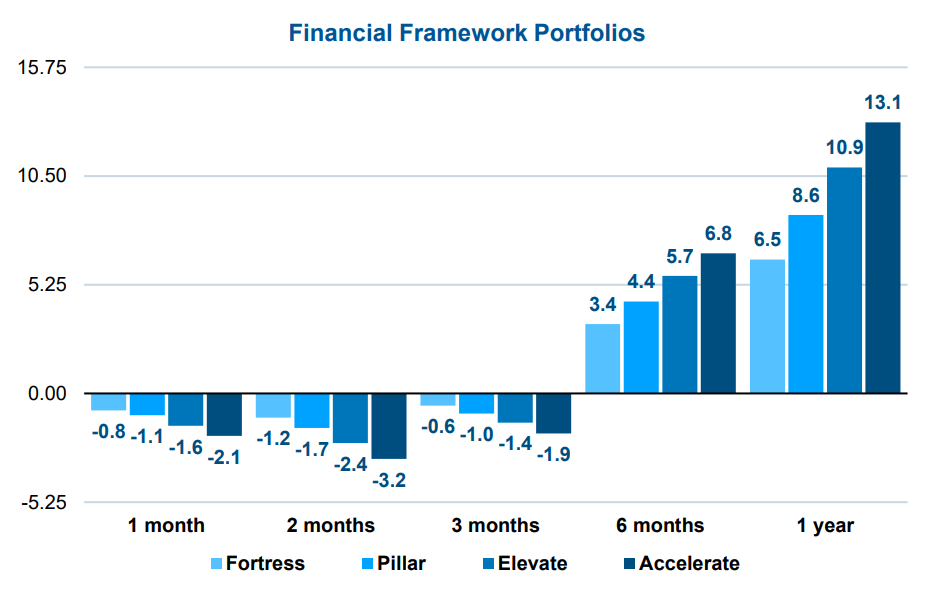

Portfolio Summary

The Portfolios held up reasonably well in the quarter in light of the tough conditions for growth assets, with diversification showing its importance along with strong investment selection. Our Global equity holdings in particular outperformed the broader market, with especially strong performance from the T. Rowe Price Global Equity Fund, which benefited from its emerging market allocation. Cash and bond investments held up as expected in the quarter with no real highlights. The main negative for the portfolio was the allocation to listed Australian and Global property markets as investors sold these sectors on concerns about rising bond yields. These concerns are unfounded from an Australian bond yield perspective as the economy continues to operate with spare capacity. While we agree US bond yields will rise, we don’t see the same sharp rise the market is now forecasting, so remain comfortable with allocations to listed property.

Direct Australian Share Portfolio

In line with both domestic and global markets, the Bellmont Consolidated Value Portfolio fell in the March quarter, down 6.1% for the period, compared with a fall of 3.9% for the benchmark ASX200 Accumulation Index. Ironically, this occurred despite one of the strongest domestic reporting seasons in some years, with particularly strong profit growth from the resources sector and encouraging signs for the economy more broadly, with profits driven by strong top line sales growth, rather than the cost cutting which had dominated previous reporting seasons.

Although it doesn’t make for flashy performance numbers in the short term, market conditions such as these are ideal for us as long term investors. With earnings growing but share prices falling, future return prospects improve markedly. Fortuitously, this sell-off also occurred at a time when the portfolio had a considerable cash weighting, with stocks that meet our exacting requirements in terms of both quality and value having been thin on the ground. This gives us the luxury of an ample war chest to deploy when pockets of value re-emerge. While the market as a whole remains far from cheap, we have taken advantage of a couple of buying opportunities in the last quarter, but with a still high cash weighting of around 17% at the end of the period, we will be cheering the market down further in the next few months, hoping that we may be able to put more of this cash to work in the near term. Despite being one of our worst performers for the period, with a return of -16.4% for the quarter, Mineral Resources (MIN) is arguably also one of our holdings with the most exciting future prospects. The company once again delivered a handy set of profit numbers at their half yearly results, with earnings per share (EPS) up an impressive 24%, and an incredible 289% over the last 3 years! Yet the company is doing anything but resting on its laurels, with an impressive array of growth projects under way that have the potential to drive earnings significantly higher again over the next 5 to 10 years. Central to all these projects is their unrelenting drive to utilise innovative solutions to improve efficiency and reduce costs for both their own mines, and those of their mining customers. Crucially, the company seeks wherever possible to structure the revenue from these solutions as an annuity, rather than the traditional capital expenditure model that dominates the industry – at once taking the company from being a price taker to a price maker, and removing them from the usual cyclicality suffered by most mining services companies. While it’s highly unlikely that all the company’s myriad projects will see the light of day, and not all that do will be successful, it’s this culture of innovation coupled with intelligent financial structuring, all driven by an outstanding founder-led management team that makes us very happy long term shareholders. We’ve been busily taking advantage of the recent weakness in the share price to increase our holding in this extremely high quality business at what we believe will turn out to be very attractive prices in coming years. At the end of the quarter, Mineral Resources (MIN) was our second largest holding, representing just over 7% of the portfolio.

On the positive side of the ledger, Flight Centre (FLT)continued to soar, up just over 30% for the period after reporting a 37% jump in first half earnings. Completely unloved by the investment community just over 12 months ago, with many short sighted analysts ready to relegate their predominantly bricks and mortar travel agent model to the history books, the share price has more than doubled as the company proved the nay-sayers wrong. With company owned operations in 23 countries, and a unique ownership driven culture that permeates every level of the organisation, the company’s long term prospects continue to look bright, although at current levels the shares are beginning to look somewhat expensive.

A new addition to the portfolio in the quarter was Domino’s Pizza Enterprises (DMP). Domino’s operates a global pizza franchise with well over 2,000 stores, including significant operations in Australia, New Zealand, Japan, Germany, France, Belgium and the Netherlands. Their relentless focus on improving the efficiency of their operations (the similarities with Mineral Resources have not gone unnoticed!) has seen them pioneer numerous innovations, which they test in their corporate stores before rolling out across their global franchise network. Led by a dynamic founder-led management team, the company has managed to grow EPS at an incredible 26% annual rate over the last decade, while maintaining an impressive Return on Equity (ROE) of almost 30%. A weakening share price in the last year has finally given us an opportunity to buy shares in this very high quality company at what we consider to be an attractive price. We will be on the lookout for opportunities to add further to our holdings in coming months.

To find out more about our investment services, please visit our Investment Portfolio Management page here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial advice prior to acting on this information.

Synchron Privacy Policy

Investment Performance: Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.

Financial Framework Pty Ltd t/as Financial Framework ABN 34 465 945 965 are Authorised Representatives of Synchron AFS Licence No 243313