Market and Economic Update

The March quarter was an interesting combination – of strong returns from all the major growth asset classes, offset by one of the sharpest falls in government bond markets in decades. What’s interesting about this combination, is that a falling bond market, which occurs when interest rates rise, is normally a headwind to share markets, property, and infrastructure. This is because the interest rate paid on government bonds is used as an input into the pricing of all other markets. That is, if the rate of return you can get from investing in a government bond increases from 1% to 2%, then you should logically require a similar increase in returns from investing in riskier assets such as shares or property – which usually translates into paying lower prices in those markets. Further to this, higher interest rates are also a significant expense for Infrastructure and Property assets especially, which tend to carry a fair amount of debt. So to see all these growth assets perform strongly, with International Property leading the way with an impressive 8.8% return, all while interest rates rose strongly is quite curious indeed, and shows the strength of investor sentiment in the period to push markets higher despite this interest rate headwind.

This powerful investor sentiment seems to have been driven by a combination of the passing of US President Joe Biden’s $1.9 trillion stimulus package, along with strong vaccine rollouts in the UK and USA in particular, enabling investors to more confidently look towards a ‘post-COVID’ environment. Unfortunately, positive news on the vaccine front is far from a global issue, with Europe’s rollout mired in red tape and bureaucratic wrangling, even resulting in a reintroduction of lockdown restrictions in some areas. Given these issues, it was perhaps unsurprising that the US market led the way with a strong 7.5% return, with Europe lagging somewhat, but with a still-impressive 5.3% return in the period, courtesy of improving economic data.

But the area of the market that really warrants watching moving forward is inflation and in turn bond markets. While markets broadly appear to have taken this quarter’s bond market falls in their stride, any signs of a more significant resurgence in inflation are likely to be negative for growth assets. While central banks have been struggling for years with inflation rates below their targets, the current combination of economic reopening, enormous fiscal stimulus, near-zero interest rates, and quantitative easing do mean that it’s a very fine balancing act, to ensure that inflation only reaches, and doesn’t meaningfully exceed central bank targets. Central banks have come a long way in the sophistication of their policy tools in the last 20 years, but it would be naive to dismiss the possibility of the inflation genie getting out of the bottle, so is definitely something we will be watching closely.

Portfolio Summary

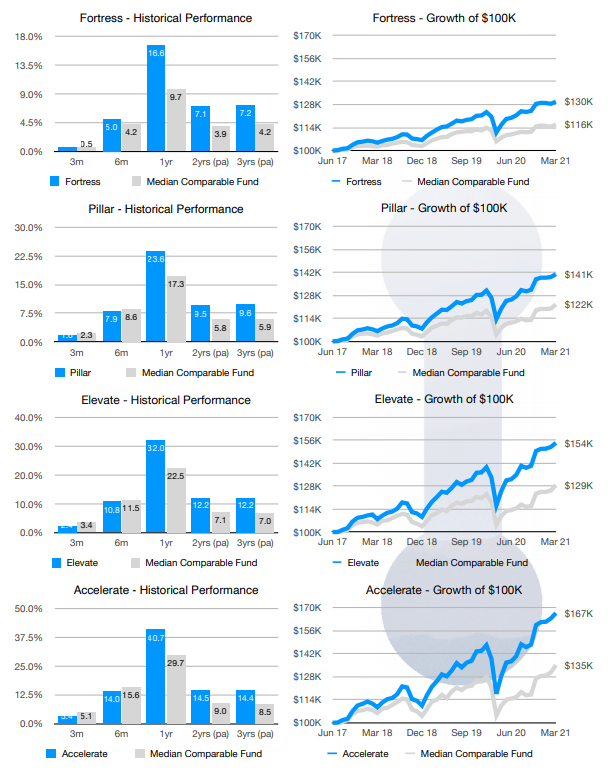

The Financial Framework model portfolios continued to perform strongly in absolute terms in the March quarter, although they did lag their benchmarks somewhat in the period, with the market rotation into the Covid-exposed losers of 2020 catching many managers off guard. Over the long term though, the portfolio’s numbers continue to look exceptionally strong, both in absolute and relative terms, with returns over 1, 2, and 3 years all significantly above both our long-term return expectations and the performance of other comparable funds.

Looking in more detail, and in Australian Equities, the Bellmont Consolidated Equities portfolio underperformed in the period, with a 2% return lagging the 4.3% return of the benchmark, as a result of the recent resurgence in ‘value’ stocks in the market, including banks – which we have some exposure to, but nowhere near as much as in the benchmark ASX200 Accumulation Index. In smaller companies, the Flinders Emerging Companies fund managed to outperform their benchmark by more than 1%, with their returns helped by significant holdings of cyclical companies, that perform strongly when economic growth picks up.

In International Equities, all our funds delivered strong returns in the period, with returns ranging from 3.6% to 5.2%, but none managed to keep pace with the strong 6.3% return of the benchmark, that like the Australian market was driven primarily by a strong resurgence in previously unloved ‘Value’ stocks, that had suffered through 2020 during the depths of COVID. Interestingly, our best performing holding in the period was the Vanguard All-World ex-US Shares ETF, which as a broad, market tracking fund naturally holds those unloved ‘value’ stocks that rallied so strongly in the period. Magellan and T. Rowe, while delivering quite reasonable returns – with their higher quality and more technology-focused holdings didn’t quite manage to keep pace amid this rapid market rotation.

Quay Global Real Estate produced excellent results, with almost a year worth of returns in the quarter, but still underperformed the rise in the benchmark, which was driven primarily by COVID exposed sectors like retail and office, to which Quay holds only modest exposure. 4D Global Infrastructure had a weak result in both absolute and relative terms – with their exposure to emerging markets hurt by a strengthening US dollar, as well as the market rotation back into more cyclically exposed infrastructure sectors, which rallied strongly.

Moving on to the bond market, and there really wasn’t anywhere to hide in the quarter, where we saw what we would normally consider being a year’s movement in a space of only 2 to 3 weeks, as improving global sentiment regarding the economic recovery and emerging concerns around inflation saw sharp price falls. Pleasingly, all our funds were much stronger than the broader market, with their corporate bond exposures generally enabling the funds to claw back some of their losses on government bonds in the period.

Direct Australian Share Portfolio

The Australian share market continued its strong performance in the March quarter, delivering a solid 4.3% return to cap off an extraordinary 12-month recovery of 37.5% from the COVID lows of last March. While our Bellmont Consolidated Equities Portfolio underperformed in the quarter with a more modest 2.0% after fees return, our 64.4% after fees return over the last 12 months is almost 30% above the market’s full-year results. Pleasingly too, our longer-term performance numbers remain exceptionally strong, with our 14.1% p.a. after fees returns since inception almost double the market’s 7.8% p.a. return over the same period.

Key in the period was the December half-year company profit reporting season, which delivered what can only be described as exceptionally strong results across the board. Despite the dire predictions of many commentators, the Australian economy, and Australian businesses proved remarkably resilient in the December half, aided in no small part by extraordinary government stimulus and further drastic cuts to borrowing costs, but also helped along by robust consumer spending, redirected away from international travel due to border lockdowns.

Unsurprisingly (in hindsight!) in this environment, it has been our retail companies that have really led the way in terms of returns in the last 3 and 12 months, with Harvey Norman (HVN), Super Retail Group (SUL), and JB HiFi (JBH) among our 5 best-performing holdings in the March quarter, and Accent Group (AX1), Super Retail Group (SUL)and Harvey Norman (HVN) in the top 5 over the last year. While the recent tailwind these companies have enjoyed is sure to moderate in the medium term as government stimulus is withdrawn and international travel opens back up again, there are also some enduring positives for retail companies moving forward. Retail rents – often a retailer’s single largest expense, appear likely to be substantially lower moving forward, as a result of increasing vacancies as weaker retailers shut their doors, offering significant margin improvements and wonderful opportunities for more rapid store expansion for growing businesses such as Accent Group (AX1). There have also been some of what appear to be more permanent changes in market dynamics, such as the proliferation of home offices, which is likely to have enduring benefits for JB HiFi (JBH), and the growing popularity of domestic leisure activities like camping and fishing that could provide longer-term tailwinds for Super Retail Group (SUL). In short, while extraordinary conditions have led to supercharged results in the recent past from our retail holdings, given the combination of a strong economy, improving market dynamics, and still relatively inexpensive valuations, we remain confident of solid returns moving forward as well.

On the negative side of the portfolio, easily the poorest performer over both the last 3 and 12 months has been A2 Milk (A2M), which fell 32% in the March quarter, and is now 42% below the level that we purchased it at, in our systematic rebalance in early December. The company’s sales continue to be challenged by COVID related restrictions on international travel, with their crucial ‘Daigou’ channel hampered by a lack of Chinese students and travelers, who have traditionally purchased large volumes of premium international brands such as A2 Milk (A2M) in Australia, then carried the goods back to China to on-sell. Compounding the effects of this difficult operating environment is a complex political backdrop, with China targeting Australian-made products with punitive tariff barriers – fear of which seems to have spread to A2 Milk (A2M) shares despite the fact that it’s actually a New Zealand company! And rounding out the trio of recent difficulties for the company has been negative media attention relating to the messy dismissal of the company’s high-profile former CEO Jayne Hrdlicka. Despite these challenges, with strong profitability, an exceptionally robust balance sheet, and the likely resumption of international travel on the horizon, we remain very confident in the company’s ability to ride out this difficult period and come out strongly on the other side.

After the completion of the rebalance of the systematic side of the portfolio in the December quarter, the March quarter saw us undertake only two small transactions. We sold the last of our Domino’s Pizza Enterprises (DMP) holdings, which despite having delivered us an outstanding 35% p.a. return for us over our 3 year holding period, we deemed to be a bit too richly priced after their recent share price rally. We would be delighted to buy back into the business at lower levels in the future if the opportunity presents itself, but at these levels, we were comfortable that we could reinvest these funds more profitably elsewhere. On the flip side, we topped up in one of our long-term holdings – Magellan Financial Group (MFG), increasing our weighting from 1.2% to 3.2%. With the Magellan (MFG) share price has fallen by around 40% since we reduced our holding just over 12 months ago, yet the company’s Funds Under Management and profits growing by around 10% in the same period, we felt that sufficient value had re-emerged to warrant increasing our holding in the company again. While we have no view on where the share price is likely to head in the short term, we are confident that the business’s long-term prospects are bright, and expect to achieve solid returns from our purchase of shares at these levels.

Despite increasing confidence in the world’s ability to eventually emerge from the grips of COVID, there are, as always a smattering of clouds on the horizon for investment markets. This need to balance the positives of economic re-opening against the negatives of potential vaccine-resistant virus mutations and the specter of increasing inflation leaves us very grateful to have such an outstanding suite of managers looking after our funds, who will make any necessary adjustments to their portfolios as conditions change, in order to best protect and grow your capital over the long term.

Model Portfolio Performance

Note that actual portfolio performance will differ from model performance, based on entry and exit date, rebalance frequency, and other factors. Performance numbers quoted are after investment management and performance fees but before transaction fees, platform fees, and taxes.

To find out more about our investment services, please visit our Investment Portfolio Management page here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial advice prior to acting on this information.

Synchron Privacy Policy

Investment Performance: Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.

Financial Framework Pty Ltd t/as Financial Framework ABN 34 465 945 965 are Authorised Representatives of Synchron AFS Licence No 243313