Market and Economic Overview

The September quarter saw investors largely turn a blind eye to rising economic and political risks. None of these risks were particular new (tariffs, Brexit, China, central bank policy), but volatility remained very low in an environment where the potential probabilities of something going wrong clearly rose. Central bank support remains key here.

In saying that, and most importantly for long term investors, underlying market fundamentals remain sound and possibly improved during the quarter, owing to strong company earnings with profit margins being maintained even in light of rising cost pressures globally. We saw strong numbers out of US and Australian company reporting season. However, while we saw strong numbers forecast again for US companies, earnings expectations have taken a step down for Australian corporates.

Closer to home, the impact of tariffs was seen via China concerns and lower commodity prices, with the resources sector hit particular hard in August. Many of the China fears are overdone, and whilst we are keeping a watchful eye, right now it’s not something we’re overly concerned with. Australian house prices were obviously front and centre given the amount of news flow, which wasn’t helped by the backdrop of the Banking Royal Commission and banks raising mortgage rates out of cycle.

In terms of markets, we saw very strong returns from global equities over the quarter, with US (boosted by Tech stocks) and Japanese equities powering ahead. European equities struggled in light of Brexit and trade concerns. We saw reasonable returns from Australian equity and listed property markets, while global bond and global listed infrastructure came under pressure in light of rising bond yields towards the back end of the quarter.

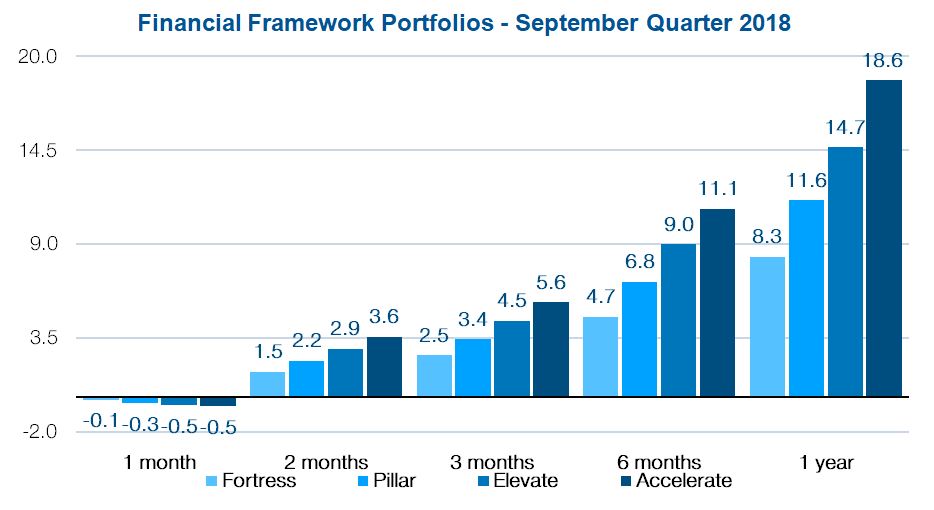

Our Portfolio Summary

The Portfolios performed strongly in the quarter, weathering some of the rising risks mentioned earlier. Standouts included the Bellmont Consolidated Value portfolio and Flinders Emerging Companies, which both benefited from being well positioned leading into reporting season and from the market’s slight shift back to a value orientation. The portfolio’s global equity holdings had some mixed results but still performed well in what was a very strong period. Bond returns were uninspiring, largely as expected.

Overall, the portfolios have been performing strongly, and remain well positioned for the period ahead.

Direct Australian Share Portfolio

Results from the Bellmont Consolidated Equities portfolio remain solid, with a 12.2% return over 6 months, and 8.9% return over the last 3 months – both comfortably ahead of the benchmark ASX200 Accumulation Index over the same periods.

As long term investors we normally pay very little attention to the daily movements of share prices, and the short term fluctuations they cause in the value of our portfolios. But if there’s one time of the year where there can be some fundamental justifications for these movements it’s the annual reporting seasoning in August, during which the majority of companies report their annual earnings and provide the market with an update on their business operations. This short period is unique, in that it is one of the rare times when the market is fully informed, and when share price movements are grounded in reality – dictated by a company’s underlying business performance, rather than the speculation that usually dominates.

We were very happy then with our 8.9% return for the just completed September quarter (which included the FY18 reporting season), well ahead of the market’s return, and driven by strong 12.9% annual earnings growth from our portfolio companies, compared with only around 8% earnings growth for the market as a whole.

Of course as always there were some disappointments, the most notable of which in regards to share price at least would have to be Flight Centre (FLT), which fell 14% in the period to be the biggest drag on the portfolio in both percentage and dollar terms. Ironically though, this was despite an excellent profit result, with earnings up 22% despite a flat result from their powerhouse Australian business, as efficiency projects led to some short term disruption. Rather than any fundamental business weakness, this fall appears to be more a moderation of the market’s somewhat overinflated expectations of the business after a stellar 150% rally in the share price over the prior 18 months. With the long term prospects for the business as bright as ever, and the share price now coming back to more reasonable levels, we will be watching closely for any attractive opportunities to add to our holdings in coming months.

On the positive side of the ledger, TPG Telecom (TPM) generated an outstanding 61% return for the quarter, driven by their announced intention to enter into a “merger of equals” with Vodafone Hutchison Australia (VHA) – a transaction that will create a formidable competitor to Telstra and Optus, with strong capability in both mobile and fixed line services. While intuitively the merger makes good sense, it’s worth noting that our comfort in the proposed transaction stems in large part from our faith in the alignment and strategic nouse of management (including founder, CEO and 32% shareholder David Teoh) rather than a detailed financial analysis of the merged entity – a process that we believe is impossible to undertake with any degree of certainty until long after the partnership is consummated. With a significant holding that we’d built up at lower prices while the business was very much out of favour, we thought it prudent to slightly reduce our holdings after this significant rally, but retain a meaningful weighting in the company, and remain very confident in its long term prospects.

Also providing the sort of positive surprise that we like was global fund manager Magellan Financial Group (MFG), which delivered a 24% return for the quarter on the back of an impressive 36% growth in earnings in FY18. The icing on the cake was the company’s announcement that with a rock solid balance sheet and sufficient capital for all possible eventualities (meaning – no debt and $445m in investment assets!), they have decided to increase their dividend payout ratio range from between 75% and 80% to between 90% and 95% – the logic of which I can’t fault. Combining the solid profit growth and increased payout ratio saw an impressive 57% increase in the dividend for FY18 compared with FY17.

And that’s all for our September quarter update. As always we will be keeping a close eye on the portfolios, and will make any adjustments that might be necessary to maximise your long term returns. If you have any questions though, please feel free to contact your adviser at Financial Framework who will be more than happy to help.

To find out more about our investment services, please visit our Investment Portfolio Management page here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial advice prior to acting on this information.

Synchron Privacy Policy

Investment Performance: Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.

Financial Framework Pty Ltd t/as Financial Framework ABN 34 465 945 965 are Authorised Representatives of Synchron AFS Licence No 243313