Market and Economic Overview

Politics and economics did their best to hamper investor returns during the September quarter, but market returns held up strongly across all asset classes with continued support by cntral bankers and continued faith by investors that those same bankers remain in control, at least for now.

The US-China trade war escalated yet again, putting further strain on manufacturing and global supply chains, while further weakening business conditions and business confidence. The Brexit debacle somehow unravelled further, with Prime Minister Boris Johnson illegally attempting toshut down parliament for well over a month in order to force a no-deal Brexit. We had the European economy continuing to weaken, with Germany heading for recession and the European central bank taking the cash rate further into negative territory, as well as announcing a new open-ended money printing program. Japanese and South Korean relations continued to sour hurting trade and tourism between the two countries, while the protests / riots in Hong Kong showed no signs of abating, crippling the Honk Kong economy and forcing some businesses to relocate to other Asian cities, namely Singapore. US-Iran-Saudi-Yemen tensions escalated with

President Trump’s sanctions on Iran forcing them to act more aggressively, which ultimately led to attacks on Saudi oil installations. On the positive side, the US economy continued to hold up well, powered by the very healthy and confident US consumer, who are generally all employed, experiencing very healthy wage increases, have seen their investment portfolios and house prices continue to rise while their debt levels have fallen, and also benefited from falling home borrowing rates in the quarter, all culminating in a significant pick-up in retail spending. In contrast, the other components of US economic growth remain stagnant, with manufacturing data starting to weaken and the one-time sugar hit from President Trump’s early term fiscal surge coming to an end.

On the local front, economic data continued to worsen, with the RBA cutting the cash rate in the quarter and drawing up plans for quantitative easing (money printing), while imploring the government to provide stimulus through fiscal means. Absent government stimulus or the Aussie dollar falling through the floor, recession is near. A couple of positives included a strong rise in Sydney and Melbourne house prices, assisted by lower borrowing rates and an easing of serviceability requirements set by the regulator, and better than expected retail sales, potentially assisted by the Government’s tax handout.

In contrast, market returns painted somewhat of a different picture, with strong returns across all assets classes bar cash. Bonds produced stellar returns, a function of significant capital appreciation, as bond yields fell sharply on increasing concerns of recession. Australian bonds were up close to 2% in the quarter while currency hedged global bonds were up 2.3%, or up 4.8% on an unhedged basis. Australian listed property and infrastructure was humming along, but saw a significant retracement in September, while still finishing up circa 1% for the quarter. In contrast, global property and infrastructure held up strongly in the quarter, benefiting from falling bond yields and investors seeking out diversification in light of rising political and economic risks. Equities were volatile in the quarter with a strong July, which was wiped out in August, before being remade again in September. All in all, Australian equities finished up 2.4% while global developed market equities were up a strong 4.6%, benefiting from a falling Aussie dollar, while emerging markets lagged.

Portfolio Summary

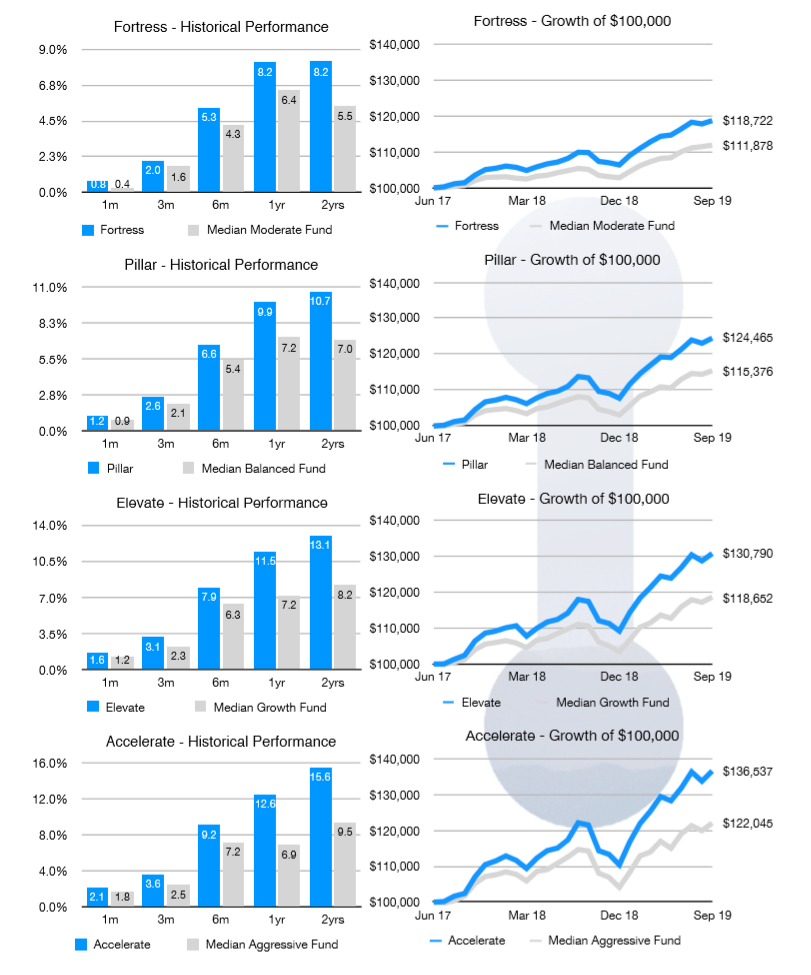

On the portfolio front, we’ve been very pleased with portfolio performance, with all of our Financial Framework Model Portfolios strongly outperforming their respective peer groups over 3, 6, 12 and 24 months, which is pleasing to see. In the quarter the Australian equity component of the portfolios contributed strongly to overall returns, with strong out performance from both the Bellmont Consolidated Equities Portfolio and the Flinders EmergingCompanies fund, with both showing strong valuation discipline in the quarter while holding their nerve during a pretty turbulent company reporting season. Bell Global Equities contributed strongly to returns on the global equity side of the portfolio, assisted by strong August, where portfolio positioning and stock selection helped produce a strong positive return in a falling equity market. While Quay Global Real Estate and 4D Global Infrastructure lagged their respective benchmarks owing to their strong valuation disciplines, they both contributed strongly to overall portfolio returns, with Quay up 7.3% and 4D up 4.4% in the quarter, with both asset classes assisted by falling bond yields and rising political and economic risks.

Detractors in the quarter included our global equity and bond manager lineups. T. Rowe Price produced a healthy 2.3%, lagging a strongly rising benchmark, hurt by their growth bias and their reasonable exposure to emerging market stocks. Vanguard All-World Ex US Shares ETF also lagged a strongly rising equity market, with European, Asian, and emerging market stocks lagging in July and August, before bouncing back strongly in September as the market rotated into areas of value. Magellan High Conviction had a strong July, but gave some of those returns back in August and September, hurt by their positioning in US healthcare stocks. The three bond managers all produced returns in line with expectations, but failed to keep pace with surgingbond benchmarks that contain considerable interest rate risk, which rallied strongly in the quarter on rising recession fears. Given how low bond yields got, we like the forward looking outlook for these managers given their interest rate risk flexibility.

Direct Australian Share Portfolio

Despite increased volatility and a lacklustre reporting season, markets continued to push higher in the September quarter, driven by a resumption of support from central banks around the globe. For the quarter, the benchmark ASX200 generated a solid but unspectacular 2.4% return, while our Bellmont Consolidated Equities portfolio generated a somewhat more impressive 3.6%return. We remain very pleased with the short and long term performance of our portfolio, with returns since inception of 14.6% per annum, comparing favourably to the 10.8% return of the market as a whole over the same period.

Globally there was no shortage of risks for investors to fret about in the period, with the ongoing Hong Kong demonstrations, US / Iran tensions, the US / China trade war and the seemingly never-ending Brexit debacle just to name a few. This proliferation of risks – none of which have been subsequently resolved – means that volatility is likely to remain high for some time, with occasional flare-ups and associated market meltdowns likely to be the rule rather than the exception. Compounding these external risks has been a string of decidedly downbeat economic data releases across the globe, suggesting that this long list of issues is beginning to have a real impact on economies around the globe.

As markets have come to expect though, central banks once again rode to the rescue, with interest rates being cut around the globe in an effort to encourage further investment and spur nascent wage growth and inflation. But while it’s the economic impacts that central bankers are targeting, it’s the valuation effect that’s driving the market higher. With lower returns available from investing in ‘risk free’ bank deposits, investors are quite rationally willing to also accept lower returns from their investments in shares and other higher risk assets – which translates to being willing to pay a higher price for each dollar of an asset’s earnings (i.e. the P/E ratio) than otherwise. In the short term this is a positive for us as investors – making us feel more wealthy by pushing the value of our portfolio up, but in the long term it’s a negative, with higher starting P/E ratios necessarily leading to lower future returns than would otherwise be the case. Of course, we can’t influence this dynamic, but we can manage our reaction to it by sticking to the fundamentals of our investment approach – searching for those high quality businesses with good long term prospects that are currently unloved by the market, and available at far more reasonable P/E ratios, but where we can still be confident of achieving strong returns moving forward.

While markets pushed higher in the September quarter and the 2019 financial year, company earnings were broadly flat. In the 2019 financial year average Earnings per Share (EPS) growth for the ASX200 was only 1.4%, and excluding resources stocks, EPS actually declined by 2%.

Fortunately, our Bellmont Consolidated Equities Portfolio fared significantly better, with an impressive 15.1% growth in average EPS – albeit helped in no small part by a 286% jump in earnings from Fortescue Metals Group (FMG). Despite this strong aggregate profit growth result, individual company performances were far more patchy than in previous periods, with enormous variability between the best and worst performers.

A couple of the portfolio’s laggards in the period deserve special mention though, especially as they are now two of our larger holdings, and ones that we have been buying more of in recent times (no surprises there – we love buying quality at discounted prices!). Mineral Resources (MIN) saw a -7.7% return for the period, despite delivering a more modest decline in earnings (EPS -25%) than they had been guiding for. While a 25% decline in earnings is not normally something that would get us enthused, in this instance it was driven by a conscious and very rational far-sighted decision to cease the export of low quality Lithium DSO (Direct Shipping Ore) that they had made significant profits from in FY18, in favour of the future export of a more highly refined product on which the company is likely to earn 4 times the profits – exactly the sort of rare, but savvy decision we love to see taken by management. This substantially reduced contribution from the lithium business was largely offset by increased earnings from iron-ore, which benefited from both greater volumes and a significantly higher iron-ore price, but aggregate profits still fell for the period.

However, these short term profit fluctuations overlook the bigger picture of a business with enormous growth opportunities in front of them, that they are investing heavily to capitalise on. During the 2019 Financial Year the company invested a whopping $858m in growth projects that are expected to contribute meaningfully to future earnings, increasing their invested capital base by an incredible ~70%! Proceeds from the partial sale of their Wodgina Lithium mine are likely to grow invested capital by another ~70% in the next few years, with management confident of achieving future returns on this vastly expanded capital base roughly in line with their historical average of 18%. The company also has a very stable base of annuity style mining services contracts, locked in for as long as 30 years in some cases, which have been growing at about a 15% annualised rate over the last decade, but which are expected to grow by something in the order of 40% in FY20. With management’s outstanding track record, and massive skin in the game we are very happy to continue to take the long view with Mineral Resources (MIN), opportunistically adding to our holdings periodically, in the expectation of very significant earnings growth over coming years. The fact that Directors of the company have bought over $50m worth of shares on market in the past year at prices substantially above current levels suggests to us that we’re not the only ones who believe the business has a bright future.

Corporate Travel Management (CTD) is another company that dragged on our returns in the period, falling 10% for the quarter. Once again this was despite a robust profit result, with the company’s earnings per share increasing by a solid 10% and Total Transaction Value (TTV) increasing by an even more impressive 30%! One of the criticisms of the company by its many detractors (most of whom are short sellers, so stand to profit from making any metaphorical molehills into mountains) has been its volatile cashflows – but with cashflows coming in at 113% of EBITDA in FY19 and at an average of close to 100% over their ten year history, I would have thought those concerns would have been well and truly silenced. The company also guided for further solid growth in earnings in FY20 – although this could be derailed somewhat if the current suite of geopolitical issues (Brexit, trade wars, Hong Kong etc) are not resolved in the first half of the year (something that wouldn’t concern us one iota, largely irrelevant as it is to the company’s long term trajectory). Overall, though we were quite impressed by the company’s results, the share price continued to slide. With increasing earnings and declining share price we were delighted to be able to increase our holdings twice in the period at what we consider to be attractive levels, and we remain very confident in the long term prospects of the business.

Fortunately there was no shortage of strong performers in the portfolio either, with our much maligned retail holdings performing particularly well. While many media commentators and financial analysts had blithely written off all retail businesses the moment Amazon reached our shores, as we had long opined to anyone willing to listen (and some who had no choice!) this simplistic and alarmist analysis has proven to be far from true. Indeed, in the 2 years since Amazon’s arrival, the earnings of our two top performing retail holdings – JB Hifi (JBH) and Super Retail Group (SUL) have grown by 15% and 12% respectively, as well as paying dividends totalling almost another 13% each. In the September quarter alone these two companies generated returns for our portfolio of 34% and 25% respectively, as they continued to surprise the naysayers with robust earnings growth despite the challenging conditions. This should come as no surprise – even in difficult environments, the most well run businesses can thrive. And as an investor it always pays to remember that the best investment returns can very often be achieved from going in the opposite direction to the herd.

While the economic and market environment continues to change with alarming rapidity, we will continue to focus resolutely on our fundamental investment approach of identifying and investing in quality businesses with solid long term prospects that are undervalued by the market. As it has historically, we are confident that this will deliver us solid returns over time.

To find out more about our investment services, please visit our Investment Portfolio Management page here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial advice prior to acting on this information.

Synchron Privacy Policy

Investment Performance: Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.

Financial Framework Pty Ltd t/as Financial Framework ABN 34 465 945 965 are Authorised Representatives of Synchron AFS Licence No 243313