Market and Economic Update

Markets finally took a breather in the September quarter, trading largely sideways after successive quarters of wild fluctuations. Relatively flat markets were driven by a continuation of the broad economic recovery, aided in no small part by extraordinary levels of government and central bank stimulus, tempered by ’second wave’ outbreaks in Victoria, as well as much of the Northern Hemisphere, including the US and Europe. While such outbreaks are a clear indication that the Novel Coronavirus is far from tamed, vastly improved management of risks, outbreaks , and COVID cases and the increasing likelihood of a successful vaccine becoming available in 2021 has supported a belief from many investors that the worst may be behind us. Only time will tell.

Prior to these ‘second wave’ outbreaks, economic data both locally and globally had begun to improve. Employment figures in both Australia and the US came in significantly stronger than expected, and while the Australian economy did contract in the quarter, the contraction was far smaller than previously feared and significantly less than what we’ve been seeing from most other developed nations. Carefully leaked elements of the federal budget towards the end of the quarter had investors feeling increasingly confident of a stimulatory budget – and for the most part, they weren’t disappointed. And, for those interested in a bit more drama in their politics, there was the US Presidential race – where Donald Trump and Joe Biden went head to head in what has widely been panned as the most appalling Presidential debate in living memory. While Joe Biden remains the favourite at this stage, recent history suggests it is far too early to rule out another Trump come from behind victory. Markets will be hoping for a clear winner one way or the other – with a disputed result the worst-case scenario in many respects.

Looking at investment markets, and the Australian sharemarket traded broadly flat for the September quarter, with Energy companies and financials both falling, offset by market darlings in the technology space, and a continued resurgence of the retail sector. Looking abroad, and International equity markets fared much better, with strong positive returns in local currencies, although this was diluted somewhat when converted back into Australian dollars, by the continued appreciation of our local currency. This also impacted the modest positive returns in global listed property, and global listed infrastructure, which translated to small negative returns in Australian dollar terms. In bond markets, we also saw positive returns in both Australian and Global bonds, with Corporate Bonds continuing to outperform their Government bond counterparts as investors are forced to move slightly up the risk curve in order to achieve their targeted returns.

Portfolio Summary

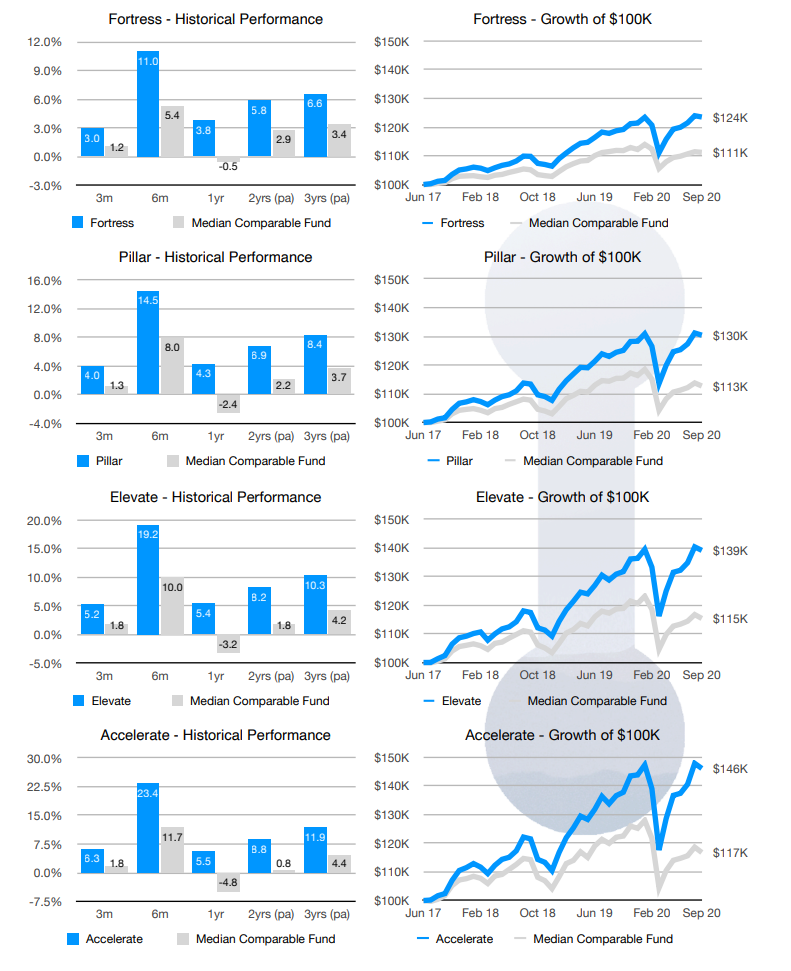

The portfolios performed very strongly in the September quarter, with strong positive returns in a period when most comparable funds only advanced modestly. In fact, the track record of all our portfolios since inception has been exceptionally strong – substantially outperforming comparable funds in all risk profiles and over all time periods. It’s important to note though that this will not always be the case! We will undoubtedly have periods where we underperform as well, but we are very happy with the performance of the portfolios to date and believe that this performance reflects positively on our patient, disciplined investment approach.

Looking in more detail at the portfolios, and there were plenty of positive contributors to our strong performance in the September quarter. Both our Australian Equities holdings performed exceptionally well, delivering well above-market returns in the crucial annual profit reporting season. While the ASX200 Accumulation Index fell slightly for the quarter, the Bellmont Consolidated Equities Portfolio delivered an outstanding 9.6% return, with the Flinders Emerging Companies Fund doing even better still, with a 10.1% return for the period.

In Global Equities, T. Rowe Price was once again the standout, performing strongly thanks to its exposure to ‘growth’ companies, that continue to attract investor interest in the current low-rate environment. Magellan High Conviction also produced a strong result, which was especially impressive considering that they held more than 20% of the portfolio in cash during the quarter. Quay Global Real Estate significantly beat its benchmark in the quarter, but still produced a negative return, with their lack of office and retail exposure assisting relative returns. 4D Global Infrastructure was one of our weaker performers, dragging on portfolio returns as a result of its exposure to more cyclical elements of the infrastructure sector, which fell as a result of the COVID ’second wave’ rolling across the Northern Hemisphere, amid concerns over the potential for more government restrictions. Our Bond managers all performed strongly in the quarter, significantly outperforming Cash returns and their respective benchmarks.

Looking ahead, and there are still significant uncertainties for investment markets, with concerns about ’second waves’ of COVID, the pending US election, and results of phase 3 vaccine trials just to name a few. Positively though, governments and central banks around the globe remain committed to doing “whatever it takes” to get the economy through this period and get the economic recovery underway in earnest. All this means that we expect markets to be broadly well supported, but further volatility should still be expected.

Direct Australian Share Portfolio

Amid the unprecedented economic and market volatility of the last 12 months, we’ve been pleased to see our Bellmont Consolidated Equities Portfolio hold up exceptionally well. Despite the ongoing impact of COVID on both the economy and a number of our portfolio holdings, since the inception of the Consolidated Equities portfolio almost 3 years ago we’ve been able to produce solid returns (post fees) of 9.69% per annum, compared with only 3.0% per annum for the market as a whole over the same period. These strong returns were aided significantly by robust performance through the COVID crisis, with our portfolio generating a 3.9% post fee return in the year to the end of September, during which time the market actually fell by slightly more than 10%. In the September quarter, we were delighted with a 9.6% post fee return, compared with a 0.4% loss for the market, driven by a very strong performance from our portfolio companies in the crucial August profit reporting season. To deliver these sorts of returns at any time is something we would be proud of, but to be able to do so through such an extraordinary period as this is particularly pleasing.

Of course, the big news of the September quarter was, as usual, the annual company profit reporting season in August. It’s fair to say that this was a reporting season unlike any other – with FY2020 for many companies a period during which they were forced to drastically alter, or in some cases even cease their operations for an extended period, stand down virtually their entire workforce, and manage the multiple additional complexities of travel bans, strained logistics networks, volatile demand patterns, and various levels of trading restrictions. Offsetting these negatives were of course an unprecedented level of government stimulus, that quite rightly provided cashflows to enable otherwise robust companies to survive through this extraordinary period.

While it’s definitely too early to suggest that we’re out of the woods just yet in terms of the Coronavirus and its associated economic impact (Churchill’s famous quote comes to mind – “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”), it’s been impressive to observe the actions of our management teams in this period, with our extensive list of ‘founder-led’ management teams worthy of special note. Interestingly, while just over half of our current holdings could be considered to be ‘founder-led’, 9 of our 10 best performing holdings in the last quarter, and 8 of our top 10 performing holdings over the last 12 months are founder-led companies. Watching the actions of these founder-led companies over the last 9 months really emphasises the immeasurable benefits of investing alongside such street-smart, determined entrepreneurs, every one of whom got where they are today by facing up to, and overcoming many seemingly insurmountable obstacles along their journey, whose own wealth is tied up in their business, and who, when backed into a corner will fight with every ounce of their being to protect, and ensure the future prospects of their business, and ours. When the dust finally settles, I’m confident that a significant majority of our portfolio companies will come out of this crisis stronger than they went in, and the true worth of our outstanding management teams will be more apparent than ever.

Of course, it should come as no surprise that against this backdrop, not all companies managed to deliver strong profit results. One of the weaker performers in our portfolio from both a business and share price perspective in the last couple of years has been Blackmores (BKL). Several years back now, the company benefited from a massive increase in sales and profits as Chinese consumers took to loading up on Australian vitamins, driven by Australia’s clean and green’ image, as well as Blackmores’ strong reputation. While sales to the Chinese market remain significant to this day, expectations of continued rapid sales growth from this market haven’t transpired, and costs have been allowed to get out of control – squeezing profits, and limiting opportunities to reinvest for crucial future growth. With new CEO Alistair Symington appointed in July 2019, management set about slimming the company’s cost base, more effectively managing their pricing (and margins), and re-establishing their growth trajectory through more targeted investment and expenditure. While FY20 profits fell by two-thirds, this should be the nadir for the company’s profitability, with one-off costs falling away, efficiency programs starting to gather steam, and solid growth in their International business (ex-China), all leading to an improving profit trajectory moving forward. While the company’s -26% return over the last 12 months makes it one of our worst performers, our confidence is building that the new management team is on the right track, and that brighter days lie ahead.

On the positive side of the ledger, it’s impossible to go past Mineral Resources (MIN), both in terms of business performance, and contribution to our portfolio. One of the few companies to be relatively untouched by COVID, MIN delivered an outstanding 63% increase in underlying earnings per share in FY2020, and an impressive 101% return for our portfolio over the 12 months to the end of September! Dividends grew by an even more impressive 127%, and the company’s balance sheet blossomed, ending FY2020 with $1.5b in cash after receiving payment from the partial sale of their Wodgina lithium mine, more than offsetting their $1.3b in debt. Just as impressive is the company’s outlook – with an objective to double their mining services business in the next couple of years (still the jewel in the company’s crown, given their long-term, contractually locked in recurring revenues), as well as enormous growth opportunities in their iron-ore business, not to mention the latent potential of their currently mothballed lithium business. Having built up a large position in the company over the last couple of years at extremely attractive prices, we found ourselves with a hefty 13% weighting in our portfolio in early August, just prior to the release of their results. With the share price has more than doubled in less than 6 months, and starting to approach our estimate of fair value, we took the opportunity to reduce our holding, back to a still substantial, but less extreme 9.5% weighting. Needless to say, we still have enormous confidence in the business and its future prospects and look forward to many more years of great returns from this exceptionally high-quality company, that is only now starting to come onto the radars of many other investors.

With such strong rallies in many of our portfolio holdings during the period, we took the opportunity to reduce our holdings in a few companies, and build back up our cash weighting. As well as the previously mentioned sale of some of our Mineral Resources (MIN) holding, we also took the opportunity to sell a few of our Super Retail Group (SUL) and Dominos (DMP) shares – both of which have performed extremely well in the last 6 months, and were either representing a significantly larger holding than we would intend or were beginning to look a little expensive. These transactions have seen our cash weighting increase from just under 2% at the start of August, to an even 10% at the end of the quarter. As always, this increase in cash shouldn’t be viewed as us making any sort of prediction about the direction of the market (something which we know we can’t do), but merely a reflection that a number of our portfolio holdings had rallied to the point where we thought they warranted a relatively smaller allocation than had been justified when they were more attractively priced, and the market hasn’t yet thrown us sufficiently tempting bargains to redeploy these funds. Our preferred position remains to be relatively fully invested, so we are keeping our eyes peeled for opportunities, but we are also more than willing to be patient until the right opportunities present.

In the coming weeks, we will be conducting our annual rebalance of the systematic side of the portfolio. The rebalance provides us with an opportunity to make adjustments for changes in both the recently reported financials of our companies as well as changes in their valuation. This may result in us trimming positions that no longer represent good value, as a result of the share price moving ahead of their fundamentals, or where the earnings of the business have disappointed.

The proceeds of the sell down and a portion of any dividends accumulated over the year are then reallocated to purchase businesses that are currently out of favour with the market, as well as potentially topping up existing positions that continue to represent good value at current prices. Importantly, there is no action required by you – however, if you have additional funds and are looking at contributing them after the middle of the month, we would suggest holding off until after the 5th of December, in order to avoid any unnecessary transaction costs.

Perhaps more so than ever right now, it’s impossible to predict where the market will head in the short term. However, we remain confident that our patient, disciplined approach of buying quality businesses, at attractive prices, will continue to deliver handsome rewards over the long term.

Model Portfolio Performance

Note that actual portfolio performance will differ from model performance, based on entry and exit date, rebalance frequency, and other factors. Performance numbers quoted are after investment management and performance fees but before transaction fees, platform fees, and taxes.

To find out more about our investment services, please visit our Investment Portfolio Management page here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial advice prior to acting on this information.

Synchron Privacy Policy

Investment Performance: Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.

Financial Framework Pty Ltd t/as Financial Framework ABN 34 465 945 965 are Authorised Representatives of Synchron AFS Licence No 243313