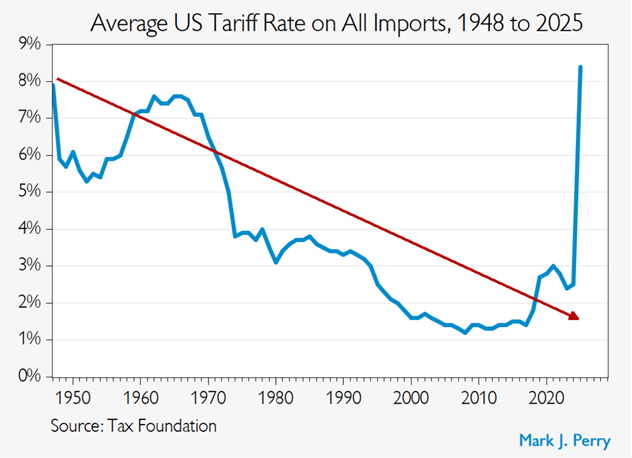

On April 2, President Trump announced his much anticipated tariffs. The depth and breadth of the tariffs caught many investors by surprise, particularly regarding a base 10% tariff on all countries and reciprocal tariffs which were used across a wider range of countries and came in at significantly higher levels than expected.

This exacerbated the risks of a global economic slowdown, with the probability of a US recession in the short-term rising sharply.

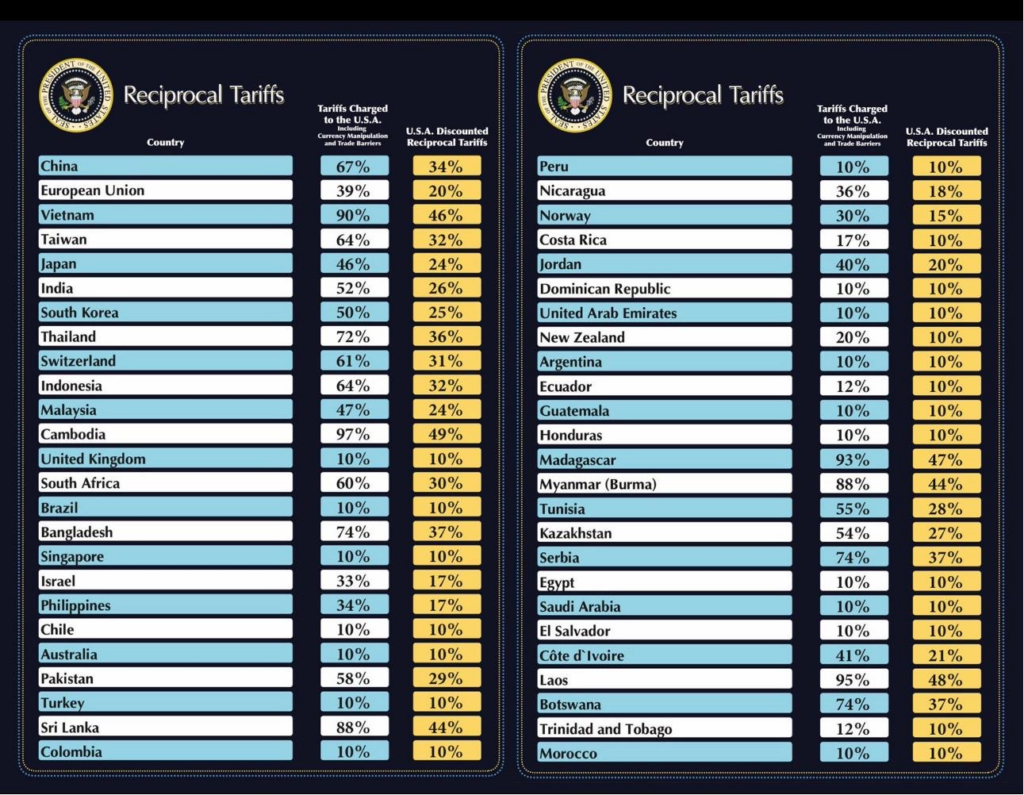

Of the major economies, China, Europe, and Japan were particularly hard hit, with China already announcing some retaliation whilst Europe and Japan are considering their options. Australia was one of the lucky ones, with only the 10% base line tariff applied.

Why was the market caught by surprise?

Whilst it’s hard to gauge exactly what caught the market by surprise, some of the factors included:

- 10% baseline tariff on all imports was unexpected

- China and Europe were singled out with 34% and 20% tariffs respectively

- Tariffs were applied to more than 60 countries

- Reciprocal tariffs were applied using trade deficits as a base, and then adjusted down for some countries based on existing relationships

- Mixed signals regarding how negotiable the US administration is going to be on these tariffs and how soon deals can be made

This was against a market backdrop of lofty expectations regarding company earnings, particularly in the US, and lofty expectations regarding the US economic growth outlook.

What are reciprocal tariffs and what has been put in place?

Reciprocal tariffs are an intention to “even the playing field” where other countries have tariffs / subsidies / trade barriers in place. Given the long history and number of trade barriers in place globally, it would’ve taken a long time and been a minefield to go after each and every single tariff one by one.

Instead, the US administration chose to use current trade deficits divided by the total imports from each country respectively, with that result halved to determine the tariff rate. This is then subject to negotiation thereafter.

The reciprocal tariffs, as published by the US administration, are as per the below (at the time of writing).

How have markets reacted?

In our view, markets have overreacted in the short term, as they usually do, and have “thrown the baby out with the bathwater”.

Equity markets have opened sharply lower in Australia and are expected to open sharply lower (circa 5%) for overseas markets throughout the day and overnight.

Key movements as follows (at time of writing):

- US equities – down 8% over the last 5 days and over 13% calendar year to date (CYTD)

- European equities – down 8% over the last 5 days and almost 3% CYTD

- Asian equities – down almost 8% over the last 5 days and 2% CYTD

- Australian equities – down almost 4% over the last 5 days and 6.5% CYTD

- US 10-year bond yield – has fallen almost 0.40% in the last 5 days and almost 1% CYTD

- AUD/USD – down 4% over the last 5 days and a little over 3% CYTD (currently at 59 cents).

What do we think?

We continue to retain a cautious posture in portfolios whilst heightening our level of supervision and monitoring. This is the environment when we expect diversification to show its true benefits.

The outsized nature and wider application of US tariffs has resulted in a recalibration of expectations ahead, many of which aren’t surprising to us. We do think things will settle as economies, businesses, investors and consumers take stock of what is now in place.

Whilst we expect the US administration to be tough in their negotiations, we also expect the more detailed and intricate negotiations to settle on a more even / fairer playing field than would be expected today.

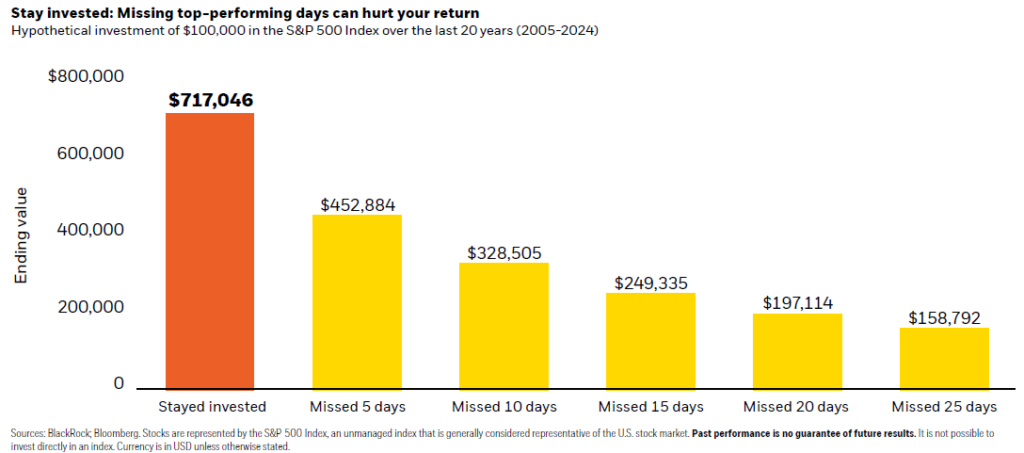

The below is a strong reminder that timing of markets proposes a significant risk to long term wealth creation. It is very important to remain invested.

Days like today, and weeks more recently, do present buying / dollar cost averaging / portfolio rebalancing opportunities, as well as an opportunity to further diversify portfolios. They also reaffirm why we manage portfolios with a conservative lens, with a dual focus on capital preservation (not beating an obscure benchmark) and market fundamentals (not momentum or emotion).